Hammad Aslam is an investor at Susa Ventures, where he focuses on Series B and Series C investments out of Susa’s Opportunity Fund, and specializes in fintech, supply chain / logistics, enterprise software and emerging markets. Prior to joining Susa, Hammad helped lead technology and software investments at Vista Equity Partners. Hammad also brings extensive technology M&A and capital raising experience from his time at Morgan Stanley. He graduated with honors from Princeton University, with an AB in Near Eastern Studies and is based in San Francisco Bay Area.

funding

Sheel Mohnot, CoFounder Better Tomorrow Ventures

Sheel is CoFounder of Better Tomorrow, a $75M seed stage venture capital fund investing in Fintech companies globally. His own startup experience includes 2 successful FinTech exits – a payments company and a high-stakes auction company, and he was previously GP of the 500 Fintech fund. He formerly worked as a financial services consultant at BCG and started his FinTech career at the non-profit p2p lender Kiva.

Minnie Ingersoll, Partner TenOneTen

Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. TenOneTen is a venture fund based in LA investing in early stage software and data companies. Prior to TenOneTen, Minnie was the COO and co-founder of recently public Shift Technologies (Nasdaq : SFT), an online marketplace for used cars. In her spare time, Minnie surfs baby waves and raises baby people.

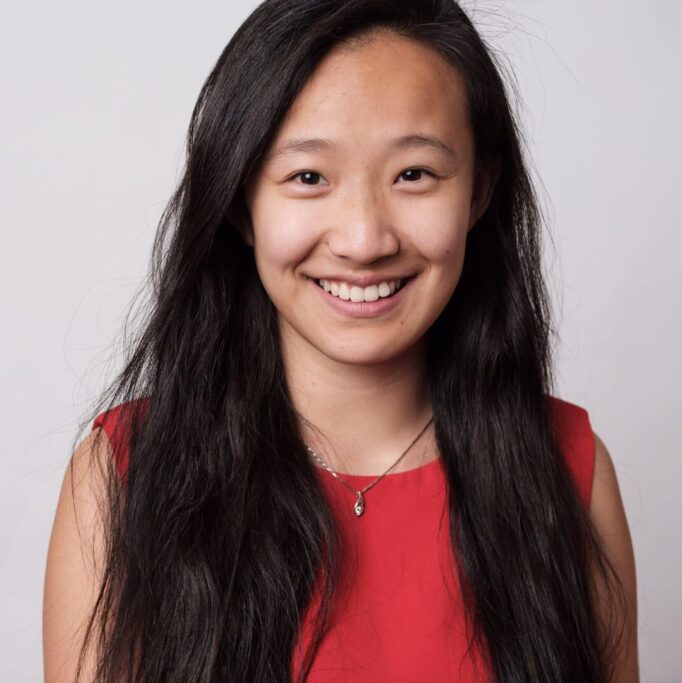

Shuo Chen, General Partner IOVC

Shuo Chen is a General Partner at IOVC, where she focuses on early stage venture investments in Silicon Valley with a focus on future of work and enterprise/SaaS. She is also Faculty at UC Berkeley and Singularity University. Shuo is appointed by California Governor Gavin Newson to serve as 1 of 13 voting members on California’s Mental Health Commission (as the first Asian American Commissioner), which includes overseeing ~$2.6 billion annually in state budget and advising the Governor or the Legislature on mental health policy.In her venture role, Shuo has invested in companies now acquired by Goldman Sachs, Ford, Caterpillar, Binance and Dialpad, as well as now unicorns including Boom, Checkr, Grubmarket, Instacart and Rescale. She has helped portfolio companies close deals with Amazon, Apple, Google, Mercedes-Benz and NASA among others, as well as scaled portfolio companies into Europe and Asia.Prior, Shuo worked at Goldman Sachs in investment banking, where she worked with clients including Alibaba and Tencent, as well as represented the firm on the Board of Women in Finance. Before that, Shuo was at PwC, where she worked on Google’s $12.5 billion acquisition of Motorola and LinkedIn’s $119 million acquisition of SlideShare. Shuo has also co-authored one of the leading books on financial regulations published by Cambridge University Press in 2019, and sits on the Advisory Board of Forbes China, where she advises on content and awards for Asian Americans in North America.